Awards were presented to several Politicians, Companies, Technocrats and Experts during the Annual Event.

ASA 2025: Sterling Bank leads Africa’s Green Revolution

FITCC Atlanta: Fidelity Bank to Spotlight Fintech’s Role in U.S – Africa Trade

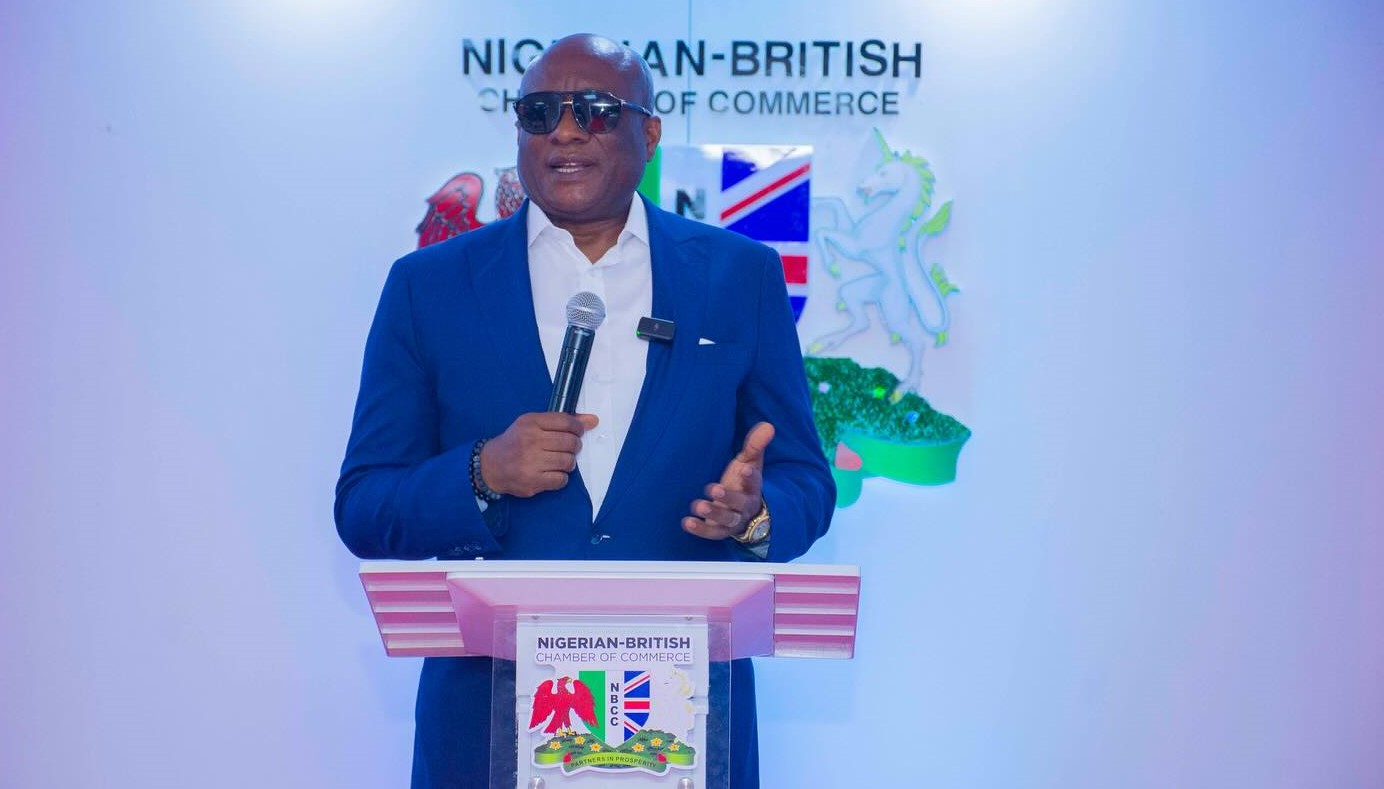

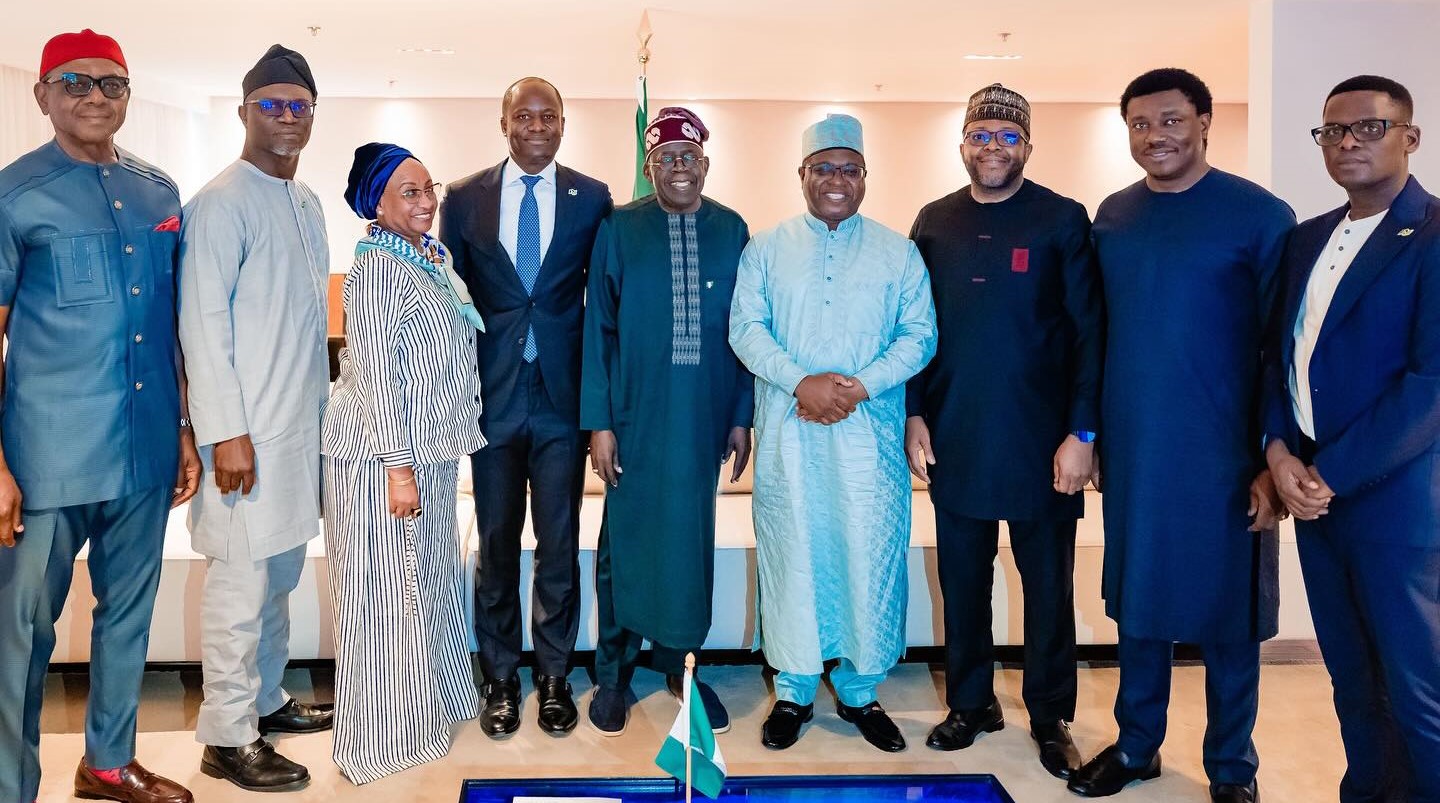

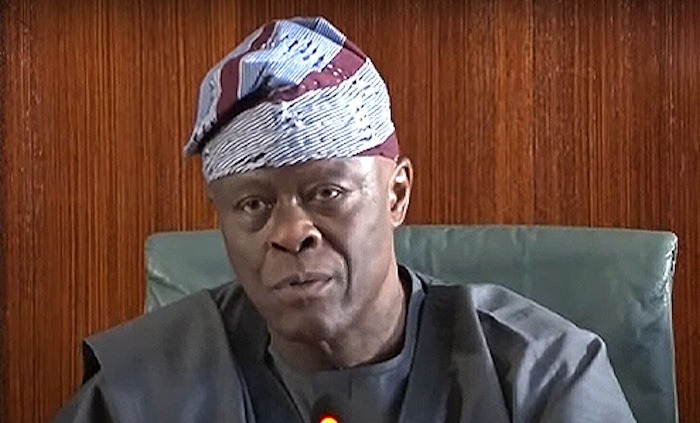

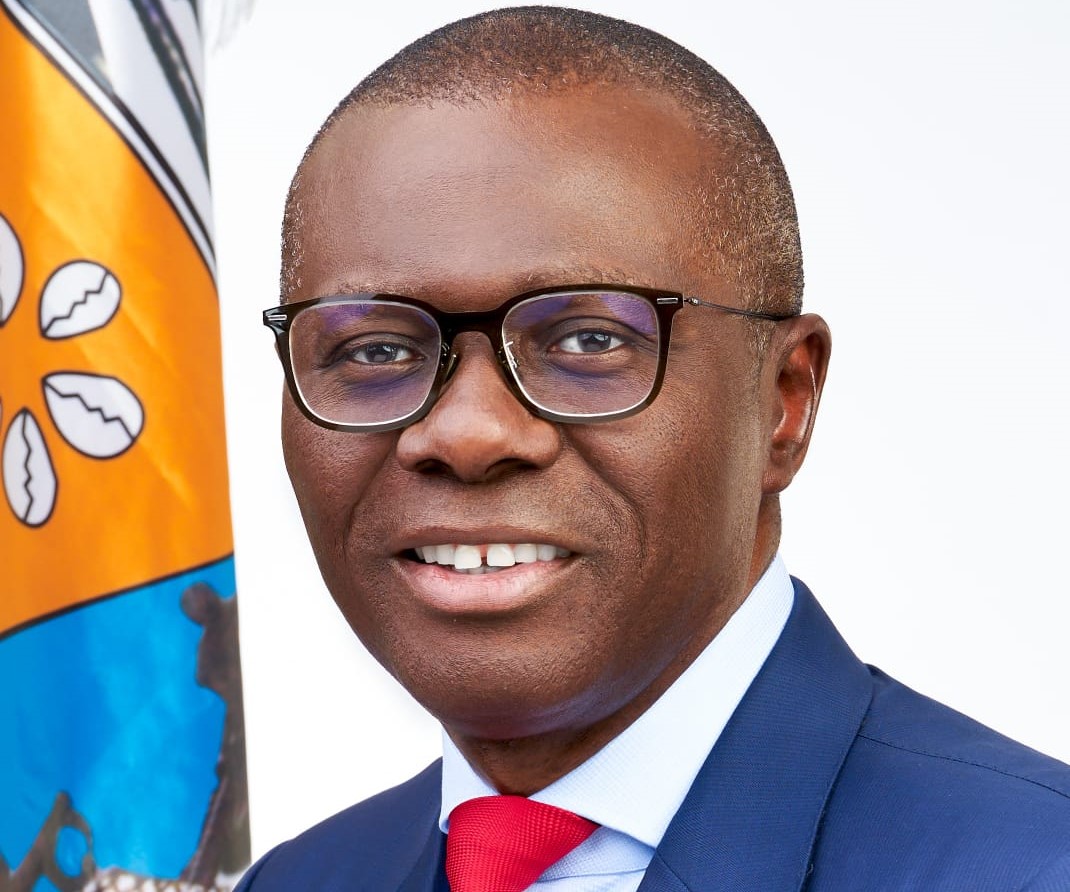

Sanwo-Olu to Lead Lagos State Delegation to FNITCC Atlanta

Leading financial institution, Fidelity Bank Plc, has announced

that Lagos State Governor – Mr. Babajide Sanwo-Olu- will lead the Lagos State

delegation to the 2025 Fidelity Nigeria International Trade & Creative

Connect (FNITCC).

In a press statement issued to journalists over the weekend, the

tier one lender stated that Governor Sanwo-Olu will use the FNITCC platform to

highlight Lagos State’s unique positioning as the largest economy on the

African continent and explore possible areas of sister city partnership with

the City of Atlanta as well as Georgia State.

“Lagos is a city of enterprise, creativity, and boundless

opportunity. At FNITCC Atlanta, we are not only showcasing Lagos as Africa’s

largest economy, but also building bridges of trade, investment, and cultural

exchange with our partners in Atlanta and the wider United States. This

engagement underscores our commitment to positioning Lagos as a truly global

city, where innovation thrives, partnerships flourish, and prosperity is

shared," stated Governor Babajide Sanwo-Olu.

Hosted in collaboration with AFRICON—the leadingglobal forum for

African innovators and change leaders—FNITCC Atlanta is scheduled to take place

from September 18 to 20, 2025. The event is expected to attract over 3,000

participants, including investors, trade agencies, exporters, and diaspora

professionals. It is expected to facilitate trade and investment transactions

exceeding US$500 million.

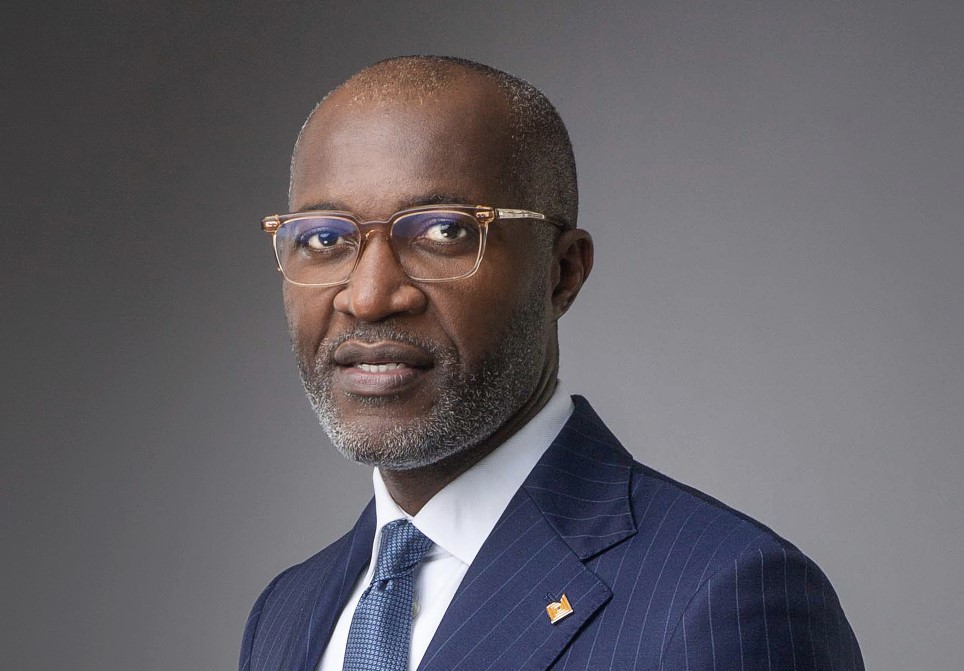

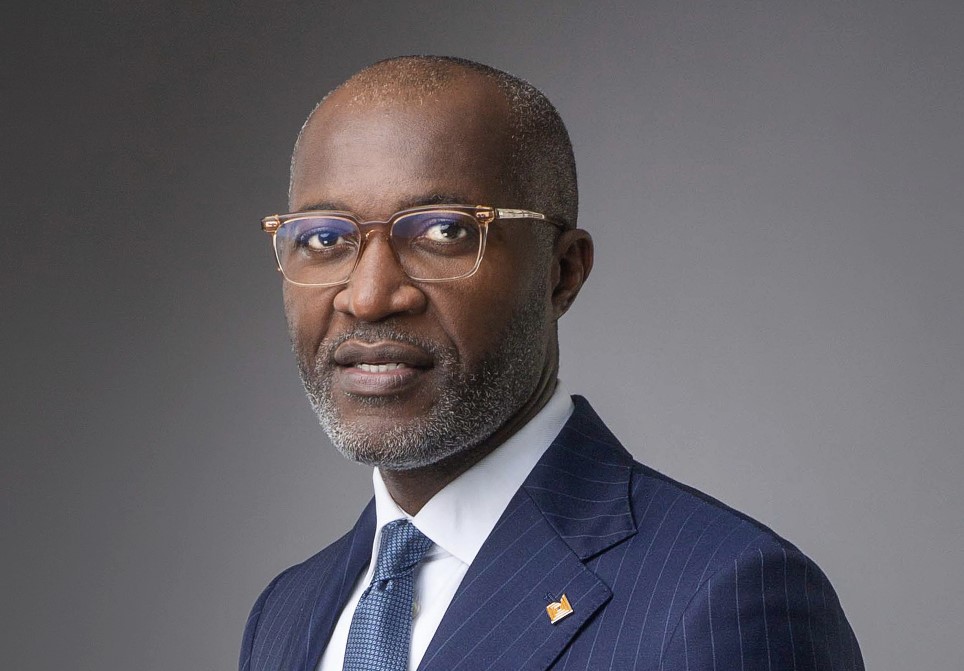

Commenting on the opportunities presented by the conference for

Lagos State, Managing Director/Chief Executive Officer of Fidelity Bank Plc.,

Dr. Nneka Onyeali-Ikpe, said, “We are honoured to host the Lagos State

delegation, led by His Excellency Mr. Babajide Sanwo-Olu, at the third edition

of our global trade initiative—FNITCC—taking place in Atlanta.

“As the largest economy on the continent, Lagos State is

well-positioned to capitalise on the wide range of opportunities we are

creating to ensure Nigerian products are effectively received within the global

marketplace, especially on the American continent through FNITCC Atlanta. This

aligns with our mission to help individuals to grow, businesses to thrive, and

economies to prosper.”

FNITCC Atlanta will feature a variety of workshops, seminars and

panels featuring prominent figures such as Mustafa Chike-Obi, Chairman of

Fidelity Bank Plc; Aishah Ahmad, Global Finance Leader and former Deputy

Governor (Financial System Stability), Central Bank of Nigeria (CBN); Abba

Bello, Managing Director of Nigerian Export Import Bank (NEXIM); and

Olasunkanmi Owoyemi, Group Managing Director/Chief Executive Officer of Sunbeth

Global Concepts Nigeria Ltd.

Further highlights include dedicated deal rooms, an exhibition

showcasing African products and services across agriculture, extractive

industries, fashion, creative sectors, and professional services; as well as

targeted matchmaking sessions connecting US buyers, investors, and partners.

Interested participants are encouraged to register for the

conference at www.fidelitybank.ng/fnitcc .

Fidelity Bank Plc is a full-fledged commercial bank with over

9.1 million customers who are serviced across its 251 business offices and

various digital banking channels in Nigeria and the United Kingdom.

The Bank is the recipient of multiple local and international

Awards, including the 2024 Excellence in Digital Transformation & MSME

Banking Award by BusinessDay Banks and Financial Institutions (BAFI) Awards;

the 2024 Most Innovative Mobile Banking Application award for its Fidelity

Mobile App by Global Business Outlook, and the 2024 Most Innovative Investment

Banking Service Provider award by Global Brands Magazine.

Additionally, the Bank was recognized as the Best Bank for SMEs

in Nigeria by the Euromoney Awards for Excellence and as the Export Financing

Bank of the Year by the BusinessDay Banks and Financial Institutions (BAFI)

Awards.

Credit Fidelity Bank PR

Sterling Bank names First Beneficiaries of ?2bn �Beyond Education� Fund

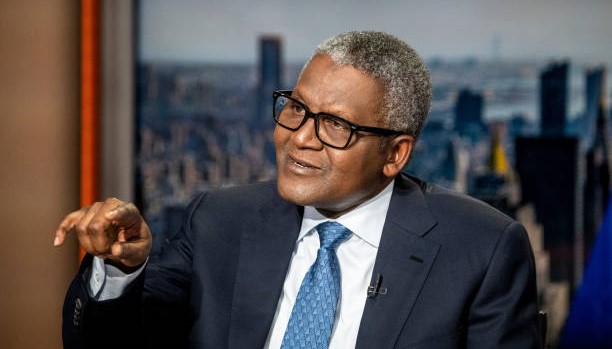

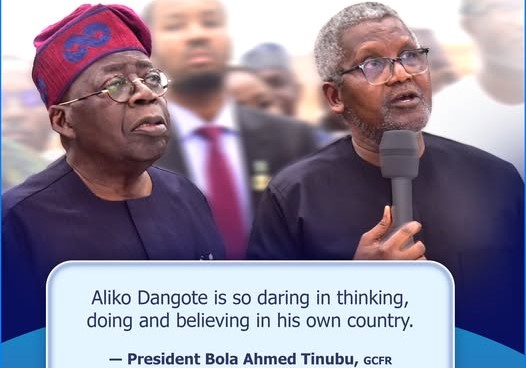

Aliko bows out of Dangote Cement as Ikazoboh moves in as Chairman

Bumper Offers as Air Peace's Abuja-Heathrow Round Trip Tickets go Live, sell for as low as N1m

Air Peace Flies Directly from Abuja to London Heathrow, Gatwick October 26

FirstBank restores Services on Firstmobile, commits to delivering seamless Digital Banking Experience

FirstBank has announced the full restoration of Services on Firstmobile, its Mobile Banking Platform, following a downtime earlier this week which occurred following a recent upgrade of the Mobile Banking Application.

Firstmobile is now up and running as the Bank remains committed to delivering seamless and innovative Financial Services to enhance the Digital Banking Experience of our Customers, irrespective of where they may be across the Globe.

However, Customers who still experience challenges in accessing or using their Firstmobile App are encouraged to contact our Dedicated Customer Service Team, FirstContact, via any of the means below:

On phone: 070 FIRSTCONTACT (0700 34778 2668228) 02014485500, 07080625000, 08070194190

Email: complaints@firstbankgroup.comand firstcontactcomplaints@firstbankgroup.com

In addition to Firstmobile, Customers can continue to enjoy convenient access to a wide range of Banking Services via our other Channels, including:

- FirstOnline � our Online Banking Platform

- Firstmonie Wallet

- Firstmonie (Agent Banking)

- FirstBank ATMs across the Country

- FirstBank Cards (Debit and Credit)

- *894# (USSD Banking)

"We are committed to ensuring that all Customers return to enjoying a seamless Banking Experience on Firstmobile as we understand the essential Role and Value you place on Firstmobile, your favourite Digital Banking Application. We sincerely regret any inconvenience caused during this Service disruption.

"For updates and more Information on FirstBank, its Products and Services, please follow us on our Social Media Channels � via @firstbanknigeria on Instagram, @FirstBankngr on Twitter and First Bank of Nigeria Limited on Facebook."

Credit FirstBank PR

ACT Foundation opens Applications for Changemakers Innovation Challenge 2024

Aspire Coronation Trust (ACT) Foundation has announced the opening of Applications for the 2024 Changemakers Innovation Challenge.

The Theme for this year�s Changemakers Innovation Challenge is �Driving Change With Digital Innovation�

This Initiative seeks to empower Community Non-Profit Organisations and Social Enterprises that utilise Technological Advancements to create Grassroots impact and enhance the Lives of Individuals and Communities.

As Technology continues to transform the Global Landscape, it offers unprecedented opportunities for Real-Time Services and improved quality of Life.

In Africa, the Social Sector is increasingly adopting Digital Innovations to address developmental challenges and improve Community well-being.

Osayi Alile, Chief Executive Officer of ACT Foundation, emphasised the importance of Technological adaptation in Africa�s Evolution, saying, �Africa is fast evolving and embracing Technology.

�As Changemakers, we must be able to move with the times and adopt innovative Digital and Technological Solutions that address Africa�s challenges in-depth, be it in Agriculture, Education, Health, or Empowerment.

�Technology has proven to aid greater impact, and this Challenge seeks to identify and support Non-Profits and Social Enterprises who are driving Social Impact through Innovative Solutions.�

The 2024 Changemakers Innovation Challenge will award Grant Funding and Technical Support to the top 3 Winners and 10 Finalists, enabling them to scale their Innovative Solutions across targeted Communities.

Interested Organisations can apply at http://changemakers.actrustfoundation.org/.

Applications close on July 12, 2024.

Winners will be announced at ACT Foundation�s 8th Breakfast Dialogue on October 10, 2024.

ACT Foundation is an Award-winning Pan-African Non-Profit Organisation dedicated to addressing challenges and vulnerabilities across the African Continent through Grant Making and Capacity Building in Health, Entrepreneurship, Environment, and Leadership.

Credit Access Holdings

NCC suspends issuance of Communications Licenses in 3 Categories

The Nigerian Communications Commission (NCC), has temporarily suspended the issuance of new Licenses in some Categories.

According to the Commission, the Categories include Interconnect Exchange License, Mobile Virtual Network Operator License and Value Added Service Aggregator License.

The Director of Public Affairs, NCC, Dr. Reuben Muoka, in a Public Notice issued in Abuja on Friday, said the Commission acted in line with its Powers under the Nigerian Communications Act (NCA) 2003.

�This temporary suspension is necessary to enable the Commission conduct a thorough review of several key Areas within these Categories, including the current level of Competition, Market saturation and current Market dynamics.

�The Public is invited to note that during the suspension period commencing on May 17, new Application for the aforementioned Licenses will not be accepted.

�This is without prejudice to pending Applications before the Commission that will be considered on their merits.

�Any enquiry or clarification in respect of this Suspension Notice should be forwarded to: licensing@ncc.gov.ng.

Credit NCC PR

Bank Recapitalisation: NDIC commends CBN on Economic resilience

The Nigeria Deposit Insurance Corporation (NDIC) has lauded the Central Bank of Nigeria (CBN) for its move to recapitalise Banks to achieve Economic resilience in the Country.

The Managing Director of NDIC, Bello Hassan, made the commendation on Friday during the NDIC Special Day at the ongoing 35th Enugu International Trade Fair.

The Fair, which began on April 5, is Themed: �Promoting Made-in-Nigeria Products for Global Competitiveness.�

Hassan pledged that the NDIC would continue to collaborate with the Apex Bank in ensuring a seamless transition while safeguarding Depositors� Interest.

According to him, in the light of the ongoing Global Economic Dynamics, the CBN has stepped up Regulatory efforts to ensure the resilience and stability of the Nigerian Banking Sector.

The Managing Director said that significant stride in this direction remained the recent revision and pegging of Higher Minimum Capital Requirements for Banks operating in Nigeria.

�Under this Proposal, Commercial Banks would be required to maintain Minimum Capital Levels of N500bn, N200bn, and N50bn for International, National, and Regional Institutions.

�As well as N50bn for Merchant Banks, while National and Regional Non-Interest Banks are required to maintain N20bn and N10bn respectively.

�This Strategic Recapitalisation Initiative is in line with President Bola Tinubu Administration's urge to grow Nigeria�s Economy to the ranks of $1trn Base Economies.

�This will not only strengthen the Banking System but would also enhance the Sector�s ability to withstand Financial Shocks,� he said.

Hassan revealed that since the CBN revoked the Licenses of 179 Microfinance Banks and four Primary Mortgage Banks in 2023, the NDIC had continued to efficiently disburse Insured Sums to Verified Depositors of these closed Institutions.

He noted that Depositors, who have undergone Verification and have provided alternative Account Details, had received their payments seamlessly within a record period of five working days.

�While it is worth noting that Depositors with amounts exceeding the Insured Limit will receive Liquidation Dividends once Debts are recovered and Assets of the Closed Banks are disposed.

�Moreover, the NDIC strongly encourages Depositors of the affected Banks to come forward with their Bank Verification Number (BVN), Proof of Account Ownership, proper Identification, and/or alternative Account Details.

�Various channels are available for Claims, including visiting nearest NDIC Offices in Person, using the NDIC App Online, or accessing the Claims Page on the NDIC website: www.ndic.gov.ng.

�Additionally, they can reach out through our Toll-Free Help Desk Line at 0800 634 424 357 for further inquiries as we remain steadfast in fulfilling our Mandate and prioritising the safety of Depositors Funds,� he said.

Earlier, President of Enugu Chamber of Commerce, Odeiga Jideonwo, said that NDIC had given Nigerians sleep and rest of mind that their Deposit is safe.

Jideonwo appreciated the work of the Corporation as it had ensured Financial stability, growth and confidence in the Financial Sector, adding those days when Depositors are worried about their Deposits are gone.

He also said that NDIC had been in the forefront of using the Fair to enlighten Depositors on how to safe guard their Bank Accounts/Deposits against Fraudulent Practices in the Banking/Financial Sector.

�The Chamber is happy that the decade-long Relationship with NDIC is very healthy and we envisage higher synergy in years to come,� he said.

Credit NAN: Texts excluding Headline

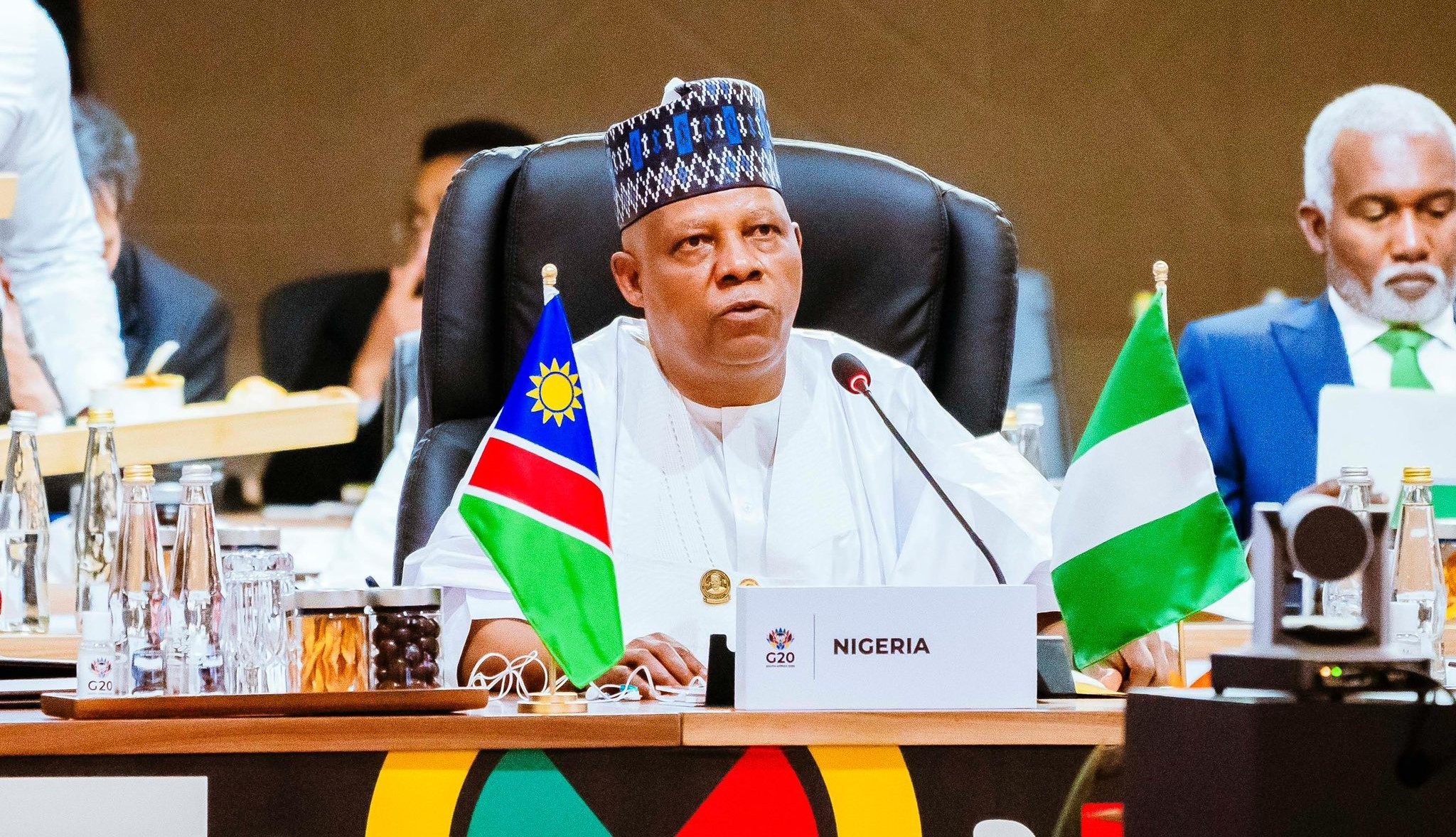

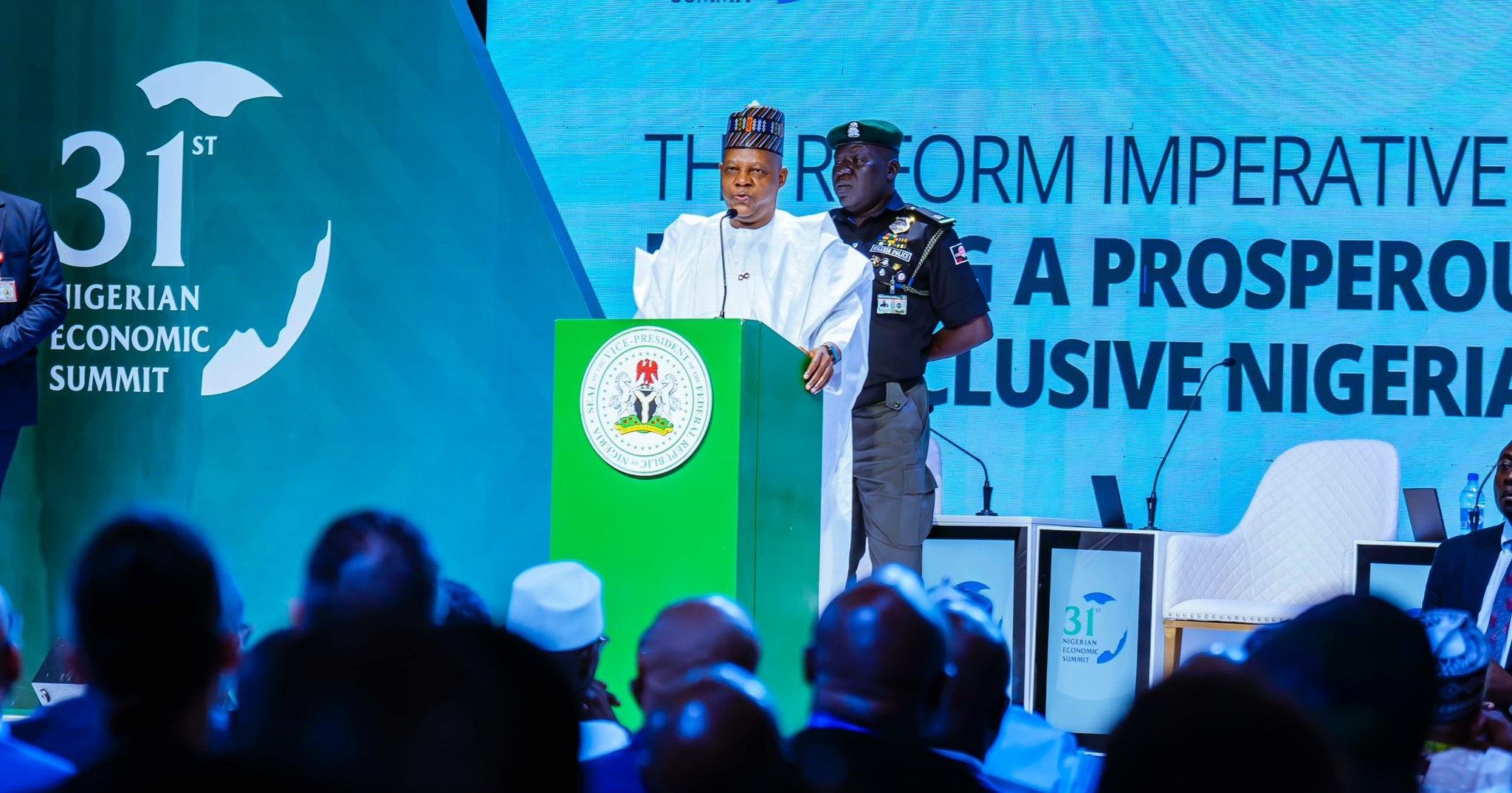

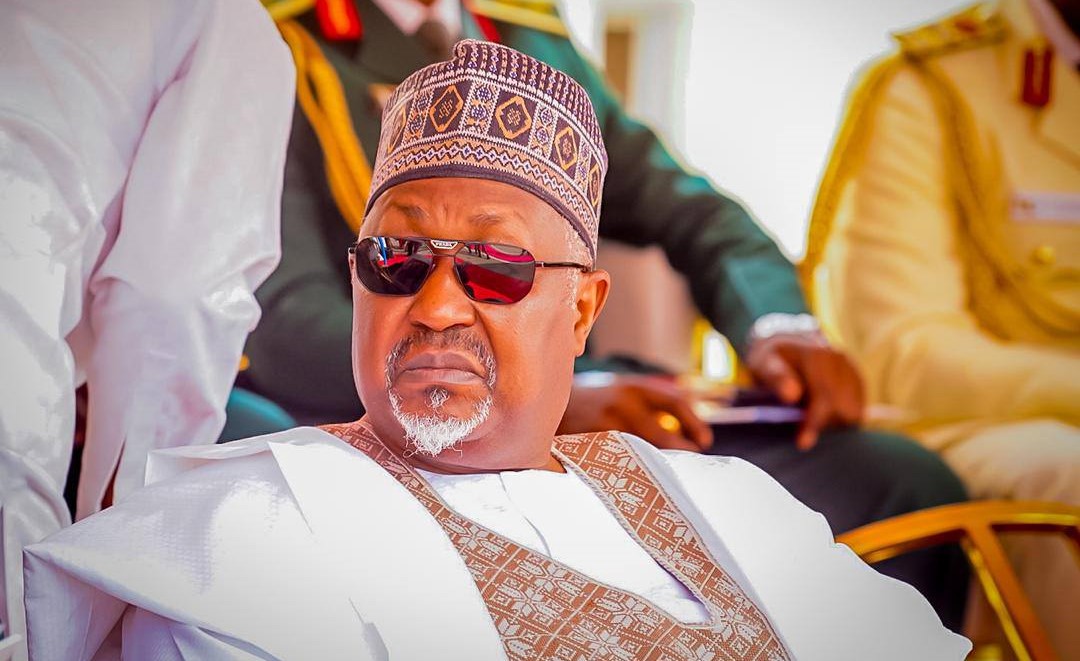

NEC establishes Committees on Economic Affairs

The National Economic Council (NEC) has constituted Committees on Economic Affairs and Crude Oil Theft and Management.

Stanley Nkwocha, the Spokesperson of the Vice-President, made this known in a Statement on Thursday in Abuja.

The Committee was constituted following deliberations on critical Economic Matters and assessments of potential short-term, medium and long-term strategies for addressing pressing Economic Issues.

Shettima chaired the 138th Meeting of NEC held virtually.

Shettima urged Members of the NEC to shelve the idea of Vacation in the Yuletide and carry on with issues of Governance to ease the burden of Nigerians hanging on their shoulders.

He also enjoined the Council Members to be alive to the demands of Nigerians noting that, �as the year draws to a close, none of us in this Chamber should anticipate a Vacation.

�I tend to think so because upon our shoulders rests the weight of responsibilities from which we cannot escape. We are returning to be judged by the promises we made to be here.

�My Principal, President Bola Tinubu, has shown that the challenges inherited by his Administration are surmountable.

�President Tinubu has offered Visionary Leadership and presented a coherent Development Plan to assist in the Country�s pursuit of order, abundance, and stability.

�Each of us owes their Constituents the Scorecard of their Stewardship in these few months of translating ideas into tangible actions.

�That�s why we can�t afford to fail, and the new year must be, for us, a timeout to reflect on how we have fared so far and what we must do differently to keep the hope of the Nation alive.�

Apparently keen about getting results of the Government�s ongoing Reforms in good time, Shettima stressed the need for the Citizens to feel the positive impact of Fuel Subsidy removal and Forex Unification.

He noted that high Inflation and Cost of Living are Global challenges that have affected the Economies of all Countries.

Shettima said they should be considered as enough �inspiration for us to come together and tackle ours through realistic interventions�.

The Committees are to be headed by Governor AbdulRahman AbdulRazak of Kwara and his Imo State Counterpart, Hope Uzodimma, respectively.

The Economic Matters Committee is saddled with the task of preparing a clear Roadmap for dealing with Petroleum Subsidy, including a Framework for defending Wage Negotiations, Exchange Rate Management and Fiscal Consolidation Sustainability.

It also includes Liquidity Management and Inflation, Medium Term Investment and Growth, Fiscal Transparency and Accountability, as well as State of Emergency on Food Production for 2024.

Members of the Committee include Governors of Gombe; Lagos, Akwa Ibom, Niger and Kaduna States representing North-East, South-West, South-South, South-East, North-Central and North West.

While Rukaiya el-Rufai, Special Adviser to the President on NEC and Climate Change would served as Secretary.

The second Committee on Crude Oil Theft and Management, an existing NEC committee, has been reconstituted with Governor Hope Uzodimma of Imo State as the Chairman.

Members of the Committee include Governors of Ogun, Plateau, Rivers, Borno, Jigawa and Abia representing South-West, North-Central South-South, North-East, North-West and South-East.

Others are: Minister of Budget and Economic Planning; Minister of Finance and Coordinating Minister of the Economy, CBN Governor; GCEO of NNPCL, NDDC Chairman, and Service Chiefs.

The Secretariat would be domiciled at the Ministry of Budget and Economic Planning and the Special Adviser to the President on Economic Matters, Tope Fasua would serve on the Committee.

Recent Posts